The Lowdown on Our Local Real Estate Market

I recently attended a great and informative presentation by Lisa Sturtevant, Chief Economist at Bright MLS, at the Fredericksburg Area Association of Realtors (FAAR) Expo 2023. As a real estate agent here in Fredericksburg, I’m constantly trying to better understand the forces shaping our local housing market to better advise you. Lisa provided invaluable insights into the current dynamics in Fredericksburg and surrounding areas. Here are some of the key things I took away:

Low Inventory Continues to Constrain

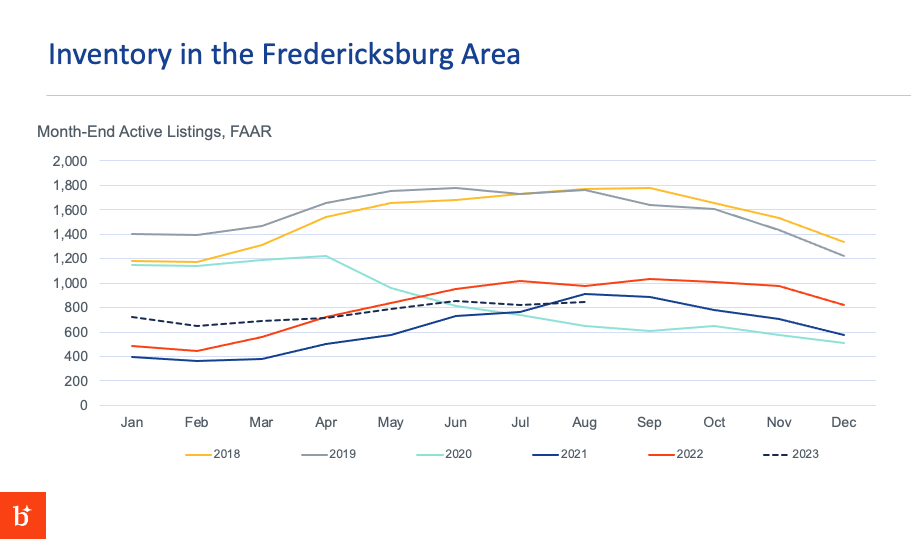

The biggest ongoing obstacle to more sales is the short supply of homes for sale. Lisa showed that active listings today remain less than half of typical pre-pandemic levels in Fredericksburg and most counties. The inadequate number of options has been wearing down buyers. Bidding wars may have eased a bit recently, but buyers still face stiff competition for the few houses available. Supply will lag far behind demand until we build significantly more new homes.

The Pandemic Impact on Interest Rates

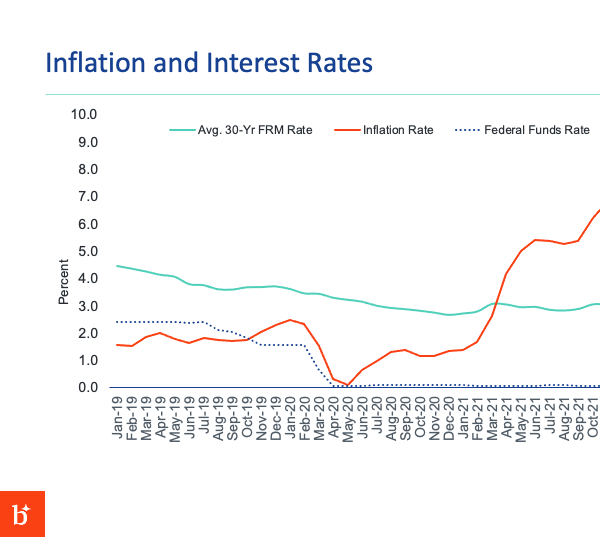

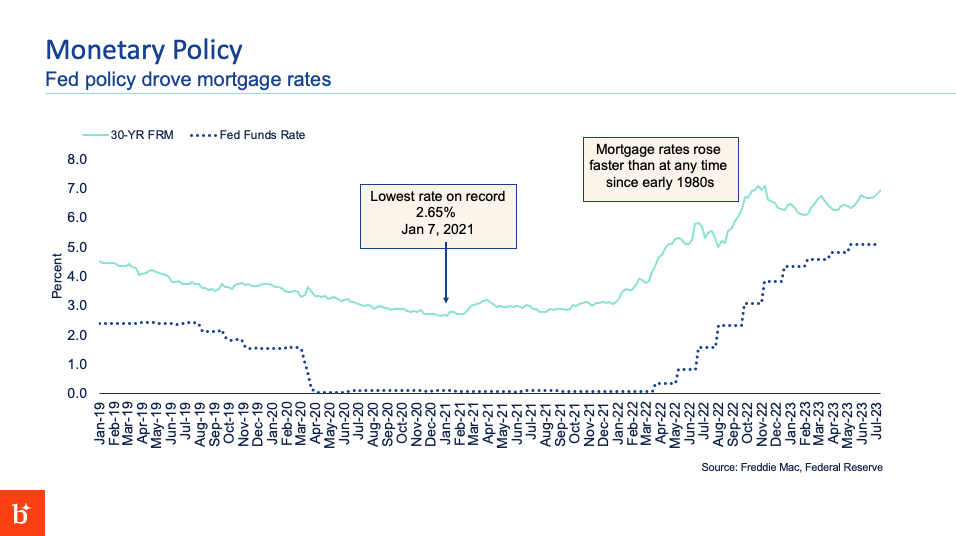

Inventory dropped so sharply due to the plunge in mortgage rates during the pandemic. The Fed slashed rates to stimulate the economy, causing rates to hit all-time lows below 3%. She also stated that she does think we will ever see rates this low again in our lifetimes. These low rates spurred a rush of buying and selling. At the same time, government stimulus payments and reduced spending left buyers flush with cash.

Of course, the Fed has since raised rates significantly to combat inflation. However, many existing homeowners locked in historically low rates under 4%, leaving them unwilling to sell or trade up to a higher rate. Until rates moderate, the inventory gridlock likely won’t break open.

Homeowners Staying Put Longer

Lisa explained that homeowners are staying put longer these days – now over 13 years on average. Retirees in particular, are less inclined to sell and relocate than in the past. Locally, many retirees choose to age in place near family rather than moving to traditional retirement destinations like Florida and Arizona. With fewer seniors selling, that removes a key source of homes coming onto the market.

The Outlook for Sellers and When Will More Homes Finally Hit the Market in Fredericksburg?

Lifestyle changes are still the top trigger, prompting homeowners to sell. However, investors listing rental properties play a bigger role as short-term rental demand softens. Lisa believes more “pent-up” sellers exist who are awaiting lower rates. But with rates elevated for the foreseeable future, sellers will have to accept that reality to list in the next couple of years.

While demographics and aging boomers will eventually spur more listings, Lisa doesn’t see inventory returning to normal for at least 3-5 years. Buyers shouldn’t wait for a flood of new listings before acting. Low rates may be gone, but staying patient for more choices could mean missing your dream home.

I’m happy to go over Lisa’s insights in more detail. Her presentation gave me an even clearer understanding of the forces directing our market. I look forward to helping you navigate these ongoing inventory challenges and achieve your real estate dreams! Check out our current up-to-date local market stats here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link