How to Winterize Your Home in Fredericksburg, VA (and Why It’s Worth Doing Early)

How to Winterize Your Home in Fredericksburg, VA (and Why It’s Worth Doing Early)

I just got my sprinkler system winterized this week, and it got me thinking about how many small things around the house need attention before that first deep freeze hits. Even here in Fredericksburg, where winters are typically mild, freezing temperatures can still cause real damage if you’re not prepared. Whether you’re a first-time homeowner or have lived in your house for years, a solid winter checklist can help you avoid costly repairs and keep your home warm and efficient all season long.

1. Protect Your Pipes and Sprinkler System

Burst pipes are one of the most expensive winter disasters and also one of the easiest to prevent. When water freezes, it expands and can crack or split pipes. To reduce your risk, wrap exposed pipes in basements, crawl spaces, or garages with foam insulation sleeves or heat tape. Disconnect and drain garden hoses, shut off outdoor water valves, and drain your sprinkler system before the first freeze. If needed, a local Fredericksburg irrigation company can handle this quickly. I have used Carney Irrigation and Lighting for years. Keep your thermostat no lower than 55°F, even when you’re out of town. Taking these precautions now can prevent leaks, flooding, and expensive water damage later.

2. Clear Gutters and Check the Roof

When leaves start piling up, your gutters can clog and trap water that freezes into ice dams, pushing moisture back into your roofline. That’s how ceiling leaks start. Clean your gutters and flush them with a hose to ensure water flows freely. Make sure downspouts direct water several feet away from your foundation. While you’re at it, inspect your roof for missing shingles or loose flashing. It’s much easier to make repairs now than during a January cold snap.

3. Inspect the Exterior

Walk around your home and look for cracks, gaps, or damage in your siding, roof, and foundation. Even small openings can let moisture in, and when that moisture freezes, it expands and makes the problem worse. If you use your fireplace, get your chimney cleaned and inspected before lighting that first fire. Creosote buildup can become a serious fire hazard. And while you’re outside, check your porch steps, railings, and decks for loose boards or supports that could become dangerous when wet or icy.

4. Seal Windows and Doors

Even a small draft can drive up your heating bill. Check the weatherstripping around windows and doors, and replace it if it’s brittle or missing. Recaulk gaps where you feel cold air seeping in. According to Energy Star, air sealing and insulation can save homeowners up to 15% on heating and cooling costs each year. For many Fredericksburg homes, especially older ones downtown, this simple step makes a noticeable difference in comfort and energy use.

5. Service Your Heating System

Don’t wait for that first cold morning to find out your furnace isn’t working. Schedule a seasonal HVAC tune-up to make sure your system is running safely and efficiently. Replace your air filter every one to three months, depending on use. If you have ceiling fans, reverse them so they rotate clockwise at a low speed — that helps push warm air down into your living space. And if you have a fireplace, make sure the damper closes tightly when not in use so you’re not losing heat up the chimney.

6. Prep the Entryway

Winter weather means muddy boots, wet coats, and dripping umbrellas. A good entryway setup helps protect your flooring and keep things tidy. Add a sturdy, non-slip mat inside and a boot tray near the door to catch snow and salt. If you have hardwood floors, consider a rug or runner to prevent moisture damage. It’s a small upgrade that goes a long way toward keeping your home clean and your floors looking great all winter long.

7. Bonus Tip: Check Detectors and Batteries

Before winter officially settles in, test your smoke and carbon monoxide detectors. Replace batteries now, and make sure you have alarms on every floor — especially near bedrooms. It’s one of those five-minute safety checks that could literally save your life.

Wrapping Up

Winterizing your home doesn’t have to be a major project. A few simple steps — insulating pipes, sealing drafts, cleaning gutters, and servicing your HVAC — can help you avoid unexpected problems and keep your home cozy all season long. If you’d like to dive deeper into national best practices, check out this helpful guide on Homes.com. It’s a great resource with more expert insight on how to protect your home from freezing temperatures, wherever you live. And if you’re local to Fredericksburg or Spotsylvania, I can connect you with trusted professionals for any of these winter maintenance tasks — from HVAC inspections to gutter cleanings. Just reach out anytime. Stay warm and stay ready, Fredericksburg.

How to Winterize an Outside Faucet

How to Winterize an Outside Faucet

As fall deepens and the evenings grow colder, it’s smart to get ahead of winter’s chill. One simple yet critical maintenance task is to protect your outdoor faucets from freezing. A frozen hose bib (that’s the fancy name for your outdoor spigot) can crack pipes, cause leaks, or lead to costly water damage. Fortunately, with a few careful steps now, you can avoid those headaches later.

Step 1: Disconnect and Drain Hoses

Remove any garden hoses or attachments from your outdoor faucets. Shake out remaining water and store hoses in a dry place. Leaving water in the hose or faucet leaves the door open for expansion and rupture when freezing hits. According to Family Handyman, turning off outdoor faucets, opening them, and draining excess water is a key part of plumbing winterization.

Step 2: Turn Off Interior Shut‑Off Valve and Drain

Inside your home (often in the basement, crawl space or utility area), there’s usually a shut-off valve for the outdoor faucet line. Close it fully. Then go back outside and open the faucet so that any water left in the line can drain out. This practice is recommended by multiple plumbing resources as essential to prevent freeze damage, including this Family Handyman guide.

Step 3: Insulate the Faucet

Even after draining, your faucet shell is exposed to cold air. Use a foam faucet cover (available at hardware stores) to wrap it. You can also use a rag or towel as an extra layer. The Portland Water Bureau recommends insulating all outdoor faucets using molded‑foam covers or protective wraps.

Step 4: Consider Upgrading to Frost‑Free Faucets

In homes with older plumbing, faucets may put the valve close to exterior frost zones. A frost‑free or freeze‑proof faucet keeps the shut‑off deeper inside the wall where it stays warmer. Even with those, basic winterization is still wise as a backup. Many plumbing guides treat frost‑free as a helpful upgrade, not a complete substitute.

Step 5: Don’t Forget Sprinklers & Other Exterior Water Lines

Outdoor faucets aren’t the only vulnerable water lines. If you have an irrigation or sprinkler system, blow out or drain it before freezing weather sets in. Exterior Medics provides a good overview of how to winterize both faucets and sprinkler systems.

Wrapping Up

Spending 15 or 20 minutes this fall to winterize your exterior faucets can save you hundreds or even thousands in plumbing repairs. As someone who lives and works in Fredericksburg, I’ve seen how small preventative tasks protect a home’s value and spare stress. If you want help building a seasonal maintenance checklist tailored to homes in our region, I’d be happy to help.

For more local homeowner tips, visit FredericksburgNow.com.

5 Smart Tips to Help You Sell Your Home Faster (and for Top Dollar)

What’s up guys! If you’ve been thinking about selling your home, you’ve probably got a lot on your mind — when to list, how to price it, and what to do to get it “market ready.” The good news? A few smart moves now can make a big difference when those buyers start walking through the door. I’ve helped a lot of sellers here in the Fredericksburg area, and I can tell you these strategies really work.

1. Declutter and depersonalize

Before your first showing, take some time to clear out the extra stuff that’s built up over the years. Buyers want to picture their life in the home, not yours. That means packing away family photos, kids’ artwork on the fridge, and anything that distracts from the space itself. I always tell clients to think “model home” vibes — clean surfaces, tidy shelves, and open floor space. Bonus tip: renting a small storage unit for a couple of months can be worth it to keep your home looking light and spacious.

2. Handle the little repairs

You know that loose doorknob you’ve been meaning to fix or the squeaky ceiling fan in the living room? Now’s the time to take care of them. Buyers notice the little things, and even small repairs can make your home feel well-maintained and move-in ready. This isn’t about doing a full renovation, but patching holes in the wall, touching up paint, replacing burnt-out bulbs, and making sure doors and windows open smoothly all add up to a better first impression.

3. Boost your curb appeal

First impressions happen before a buyer even steps inside. A fresh layer of mulch, trimmed bushes, and a power-washed driveway can instantly improve the way your home looks from the street. If your front door has seen better days, a coat of paint in a welcoming color can make it pop. Add some potted plants or seasonal flowers by the entrance for an extra touch. Buyers will feel good walking up to the door — and that feeling carries through the rest of the showing.

4. Price it right from the start

I get it — everyone wants top dollar for their home. But overpricing can backfire, causing your property to sit on the market and making buyers wonder what’s wrong with it. The first two weeks on the market are prime time for attention. Pricing it in the sweet spot where buyers see value creates urgency and can lead to multiple offers. I always recommend looking closely at recent sales in your neighborhood and adjusting for current market trends.

5. Work with a pro who knows your market

Every neighborhood is different, and Fredericksburg has its own unique trends and buyer preferences. Working with an agent who understands the area means you’ll get accurate pricing advice, a strong marketing plan, and someone who knows how to position your home to stand out. From staging advice to professional photography to negotiation skills, the right agent will help you avoid costly mistakes and keep the process running smoothly.

3 Local Tips to Make Your Fredericksburg Home Stand Out

Highlight nearby attractions in your listing description.

Whether it’s being close to Downtown Fredericksburg, the VRE station, or popular spots like Carl’s or the Farmers Market at Hurkamp Park, buyers love knowing they’re near places they’ll actually enjoy. These local details make your home feel more connected to the lifestyle they want.

Stage seasonally to match the local vibe.

In spring, fresh flowers from a local nursery like Meadows Farms can bring life to your entryway. In the fall, a simple mums-and-pumpkins setup from Miller Farms Market adds warmth. It’s a small touch that makes a big impact in photos and in person.

Show off your backyard potential.

Around here, outdoor spaces are a big selling point. If you’ve got a deck, patio, or firepit area, make it shine. Set up the seating, light the string lights, and create that “ready for a BBQ” feeling — buyers will picture themselves enjoying those summer evenings right here in Fredericksburg.

🔥 Homes Selling Fast in Fredericksburg? May 2025 Market Shifts You Need to Know

The real estate market in Fredericksburg continues to move quickly, and the numbers from May 2025 paint a clear picture. Right now, we’re looking at a 2.8 Months Supply of Inventory. In simple terms, if no new homes were listed, it would take less than three months to sell everything currently on the market. That’s tight inventory—and it’s up just slightly from this time last year.

Homes are still selling strong, with a Sold-to-List Price ratio at 99%. That means sellers are getting nearly full asking price on average. The median days on market is just 10, which tells us well-priced homes are moving fast. And the median sold price in the area is now sitting at $525,000.

Whether you’re thinking about buying, selling, or just keeping an eye on trends, staying informed is key in a market like this. If you’re curious what these numbers mean for your situation, I’m always happy to talk. Call or text me at 540-735-5564.

How to Use the Rule of Three in Home Decor (And Why It Works)

How to Use the Rule of Three in Home Decor (And Why It Works)

Decorating your home can sometimes feel like a puzzle—trying to figure out why certain arrangements just don’t look right. One simple trick that interior designers often use to create visually appealing spaces is the “Rule of Three.” This guideline suggests that items grouped in odd numbers, particularly threes, are more engaging and balanced to the human eye (House Outlook).

Why Three?

Our brains are naturally drawn to patterns, and three is the smallest number that forms a distinguishable pattern. This makes groupings of three objects—like a candle, a small plant, and a framed photo—more captivating than pairs. The trio creates a sense of movement and interest without overwhelming the space.

Applying the Rule in Home Decor

Here are some practical ways to incorporate the Rule of Three into your home:

- Vignettes and Displays: When arranging decorative items on shelves or tables, group them in threes. Vary the height, shape, and texture to add depth and interest. For example, combine a tall vase, a horizontal book, and a sculptural object to create a cohesive look.

- Furniture Arrangements: In living rooms, consider grouping furniture pieces into sets of three to define the space. A classic combination could be a sofa, an armchair, and a coffee table, which together create a balanced and inviting seating area.

- Artwork and Wall Decor: When hanging art, a trio of frames can make a wall feel complete and intentional. This can be extended to larger gallery walls by maintaining an odd number of pieces, ensuring the arrangement feels dynamic and balanced.

- Color Schemes: The Rule of Three also applies to color palettes. The 60-30-10 rule is a popular method where 60% of the space is a dominant color, 30% a secondary color, and 10% an accent color. This approach brings harmony and depth to a room’s design (Better Homes & Gardens).

Beyond Three: Odd Numbers in Design

While three is a magic number in design, the principle extends to other odd numbers like five or seven. Odd-numbered groupings tend to create a sense of movement and asymmetry, which can make spaces feel more natural and less staged.

Final Thoughts

Incorporating the Rule of Three into your decorating strategy is a simple yet effective way to enhance the visual appeal of your home. By thoughtfully grouping items, balancing colors, and arranging furniture with this guideline in mind, you can create spaces that feel both harmonious and inviting.

For more detailed insights on the Rule of Three, you can refer to the original article on House Outlook.

Houseplant Care Made Simple: How to Keep Your Plants Alive

We have a Meyer lemon tree that, up until now, has been more of a hopeful experiment than a fruitful one—literally. Despite our best efforts, it hasn’t produced a single lemon. My wife and daughters decided to take a different approach. They drew pictures of lemons and set them by the tree, hoping a little encouragement might do the trick. Well, whether it was the extra sunlight, better watering, or just sheer determination, something worked—because this year, for the first time, it’s covered in blooms. We’re optimistic that this is finally the year we’ll get some actual Meyer lemons!

I’ve never been great with plants, but I know a lot of people love having them around. So, when I came across an article from Martha Stewart about common houseplant problems and how to fix them, I thought it might be useful to share. If you’re like me and struggle to keep plants happy (or even alive), these tips might help!

One of the biggest issues with houseplants is overwatering. I’ve definitely been guilty of thinking that more water equals a healthier plant, but apparently, that’s not the case. Too much water can cause root rot, and a good way to tell if your plant is overwatered is by checking if the leaves are turning yellow and mushy. The fix? Let the soil dry out completely before watering again, and make sure your pots have drainage holes.

On the flip side, underwatering is also a problem (which I’ve also been guilty of—oops). If your plant’s leaves are wilting or getting crispy at the edges, it’s probably thirsty. A good rule of thumb is to water when the top inch of soil feels dry.

Then there’s the issue of light. Some plants need lots of sunlight, while others prefer shade. If your plant’s leaves are looking pale or stretched out, it might not be getting enough light. But if they’re turning brown and crispy, it could be getting too much direct sun. Moving the plant to a better spot can make a big difference.

Pests are another struggle, if you see tiny insects on the leaves or in the soil, you might have an infestation. The article suggests wiping the leaves with a damp cloth and using insecticidal soap or neem oil to get rid of them.

Finally, fertilizer is something I never really thought about. Turns out, plants need food too! If they’re growing slowly or their leaves look pale, they might be lacking nutrients. But too much fertilizer can burn the roots, so it’s important to follow the recommended amount for each plant.

Even though I’m not exactly a plant expert, these tips seemed really helpful for anyone trying to keep their houseplants happy. If you’ve got any plant care hacks, I’d love to hear them—drop them in the comments!

(Source: Martha Stewart – Common Houseplant Problems and How to Fix Them)

Easy Home Improvement Upgrades That Boost Your Home Value

Simple Home Improvement Projects That Dramatically Increase Your Home Value

As a real estate professional, I’ve seen firsthand how strategic home improvements can significantly impact a property’s market value and appeal to potential buyers. The good news? Not all value-adding renovations require a substantial investment or professional contractors. Here are some of the most effective upgrades homeowners can tackle themselves to boost their property’s value.

Fresh Paint: The Ultimate Transformation Tool

Nothing revitalizes a space quite like a fresh coat of paint. Modern, neutral colors can make rooms appear larger, brighter, and more inviting. Consider these painting projects:

- Update your front door with a bold, welcoming color

- Refresh kitchen cabinets with paint instead of a costly replacement

- Create an accent wall in main living areas

- Neutralize highly personalized or dated color schemes

A gallon of quality paint costs $30-$50 but can yield a return many times that investment when selling.

Lighting: Illuminate Your Home’s Potential

Updated lighting fixtures not only modernize your home but also improve functionality. Consider:

- Replacing outdated fixtures with contemporary designs

- Installing dimmer switches for versatility

- Adding under-cabinet lighting in kitchens

- Ensuring adequate lighting in dark hallways or corners

Bonus tip: Simply replacing old bulbs with energy-efficient LEDs can brighten spaces while appealing to energy-conscious buyers.

Kitchen Updates: Beyond the Full Remodel

While complete kitchen renovations deliver strong returns, smaller updates can be remarkably effective:

- Replace dated hardware on cabinets and drawers

- Install a new faucet with modern features

- Add a stylish backsplash (peel-and-stick options are DIY-friendly)

- Update appliances to stainless steel models if budget allows

Even minimal kitchen improvements often deliver the highest return per dollar invested.

Curb Appeal: Making That Crucial First Impression

Potential buyers form opinions before ever stepping inside. Enhance your home’s exterior with:

- Well-maintained landscaping and fresh mulch

- Pressure-washed siding, walkways, and driveways

- Potted plants flanking the entrance

- New house numbers and mailbox

- Clean windows and screens

These relatively inexpensive improvements can dramatically increase perceived value and buyer interest.

Smart Home Technology: Appeal to Modern Buyers

Today’s buyers increasingly expect tech-friendly homes:

- Smart thermostats for energy efficiency

- Video doorbells for security

- Programmable lighting systems

- Voice-controlled assistants integrated with home features

Many of these upgrades are DIY-friendly and can be installed in an afternoon.

Bathroom Refreshes: Small Changes, Big Impact

Like kitchens, bathrooms significantly influence buyer decisions:

- Replace dated fixtures and hardware

- Re-caulk showers and tubs for a fresh look

- Install new mirrors or medicine cabinets

- Add luxury touches like rainfall shower heads

Storage Solutions: Addressing a Universal Desire

Homes with ample, well-organized storage consistently command higher prices:

- Install closet organization systems

- Add shelving in garages or utility spaces

- Create built-in storage in underutilized areas

- Ensure pantry spaces are optimized

Final Thoughts

The most successful home improvements balance your immediate enjoyment with long-term value. Before undertaking any project, consider your timeline for selling and the typical buyer profile in your area.

Need personalized advice on which improvements would yield the best return for your specific property? Contact me for a consultation – I’m happy to provide insights based on current market trends and buyer preferences in our local area.

Are the Top 3 Housing Market Questions on Your Mind?

When it comes to what’s happening in the housing market, there’s a lot of confusion going around right now. You may hear one thing in conversation with your friends, see something totally different on the news, and read something on social media that contradicts both of those thoughts. And, if you’re thinking about making a move, that can leave you with a lot of lingering questions. That’s where a trusted local real estate agent comes in.

Here are the top 3 questions people are asking about today’s housing market, and the data to help answer them.

1. What’s Next for Mortgage Rates?

Mortgage rates are higher than they’ve been in recent years. And, if you’re looking to buy a home, that impacts how much you can afford. That’s why so many buyers want to know what’s ahead for mortgage rates. The answer to that question is: no one can say for certain, but here’s what we know based on historical trends.

There’s a long-standing relationship between mortgage rates and inflation. Basically, when inflation is high, mortgage rates tend to follow suit. Over the past year, inflation was up, so mortgage rates were as well. But inflation is easing now. And this is why the Federal Reserve has recently paused their federal funds rate hikes, which means many experts believe mortgage rates will begin to come down.

And in some ways, we’ve started to see hints of slightly lower mortgage rates in recent weeks. But it’s certainly been volatile and will likely continue to be that way going into next year. Some ongoing variation is to be expected, but the anticipation is, that in 2024, we’ll see a downward trend. As Aziz Sunderji, Strategist at Home Economics, says:

“The bottom line is that interest rates are likely to be lower-perhaps even lower than many optimists think – in the weeks and months to come.”

2. Where Are Home Prices Headed?

While there’s been a lot of concern prices would come crashing down this year, data shows that didn’t happen. In fact, home prices are rising in most of the nation. Experts say that trend will continue, just at a slower pace that’s much more normal for the housing market – and that’s a good thing.

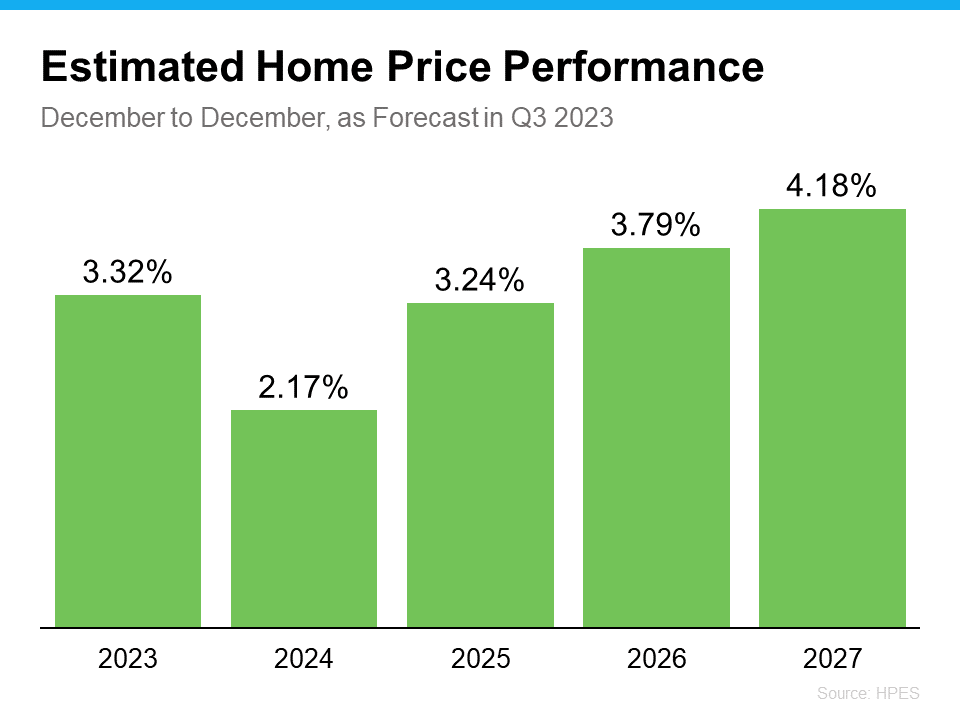

To help show just how confident experts are in this continued appreciation, take a look at the Home Price Expectation Survey from Pulsenomics. It’s a survey of a national panel of over 100 economists, real estate experts, and investment and market strategists. As the graph below shows, the consensus is, that prices will keep climbing next year, and in the years to come.

3. Is a Recession Around the Corner?

While recession talk has been a common thing over the past few years, there’s good news on that front.

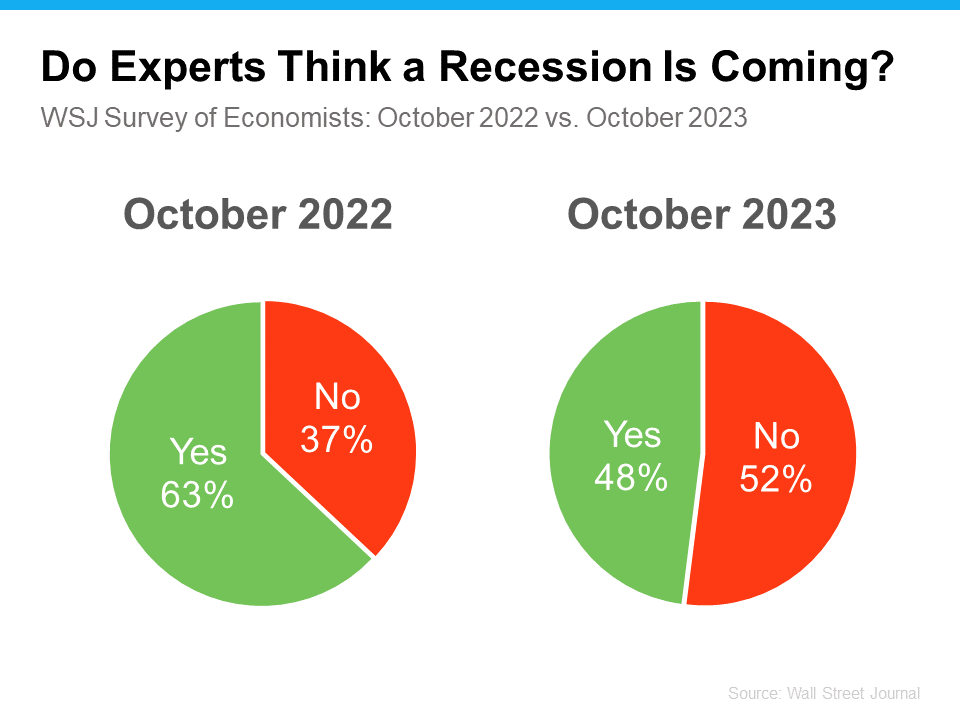

The Wall Street Journal (WSJ) polls experts on this topic regularly. And last year at this time, most of them thought a recession would have happened by now. But as experts look at all the leading indicators today, they’re changing their minds and saying a recession is getting less and less likely. The latest results show that more experts now think we’re not headed for another recession (see chart below):

This is big news for the housing market. And while the 48% to 52% split may seem close to half and half, the key thing to focus on is that the majority of these experts think we’ve avoided a recession already.

Bottom Line

The big takeaway? The data shows there isn’t cause for concern – there are actually more signs of hope. Let’s connect to talk more about the housing market questions on your mind as we head into the new year.

Life-Changing Events That Move the Housing Market

Life is a journey filled with unexpected twists and turns, like the excitement of welcoming a new addition, retiring and starting a new adventure, or the bittersweet feeling of an empty nest. If something like this is changing in your own life, you may be considering buying or selling a house. That’s because through all these life-altering events, there is one common thread—the need to move.

Reasons People Still Need To Move Today

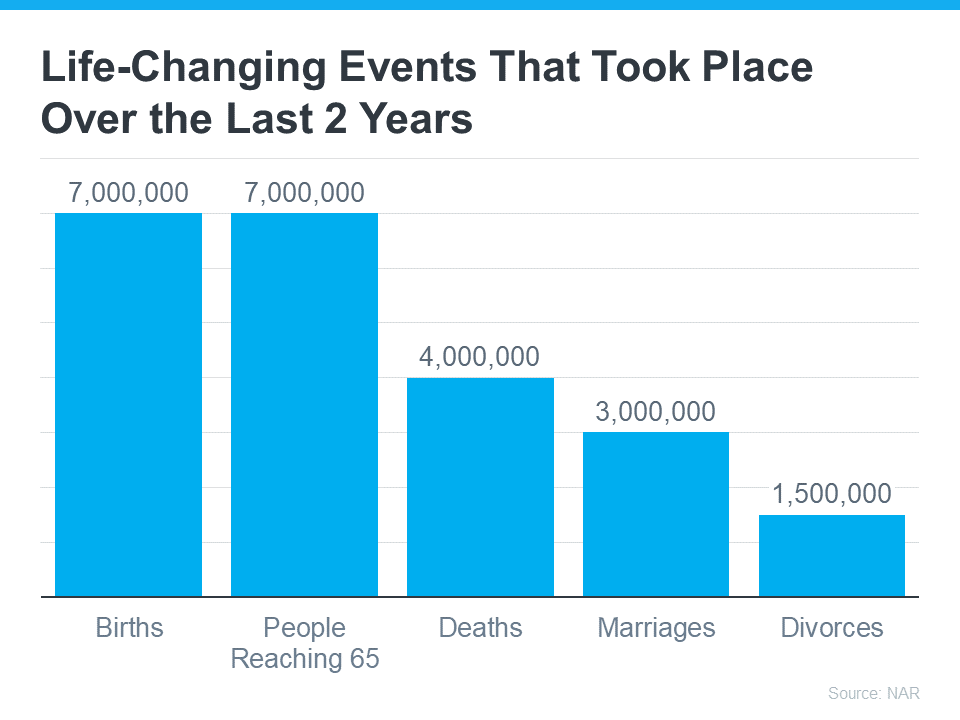

According to the National Association of Realtors (NAR) there have been a lot of this type of milestone or life change over the last two years (see graph below):

And, these big life changes are going to continue to impact people moving forward, even with the current affordability challenges brought on by higher mortgage rates and rising home prices.

As Claire Trapasso, Executive News Editor at Realtor.com, says:

“Because high mortgage rates, elevated home prices, and stubbornly low inventory make today’s housing market particularly challenging, many of today’s buyers are motivated by life changes, such as growing families, supporting elderly parents or grown children, or accommodating professional needs. . .”

Lean On a Real Estate Professional for Help

Whether you’re beginning your search for a home or preparing to sell your current house, you don’t have to go it alone. With their expertise, a real estate agent is an invaluable partner who can help you smoothly transition through these big moments in your life. Here are just a few examples.

When Buying a Home

If you’re welcoming a new addition and want more space, the need for a new home may be a top priority. While higher home prices and mortgage rates are creating challenges for buyers, you may have to find a way to meet your changing needs, even with today’s mortgage rates.

A skilled real estate agent can help. Their expertise and knowledge of the local housing market can save you a considerable amount of time and stress. An agent will take the time to understand your specific needs, budget, and preferences, allowing them to narrow down your search and present you with suitable options.

When Selling a House

If you’re retiring or going through a separation or divorce, your main focus may be to make the most out of your investment when selling your house, so you can find one that works better for you moving forward.

This is another place where a real estate agent’s expertise truly shines. They can accurately assess your home’s market value, suggest improvements to enhance its appeal, and craft a strategic marketing plan. Their negotiation skills are a big asset when it comes to making sure you get a fair price for your house, allowing you to move on to the next chapter of your life with confidence and peace of mind.

No matter your situation, lean on a trusted professional for help as you buy or sell a home.

Bottom Line

If recent life-changing events have you wanting or needing to move, let’s connect.

Decoding Home Inspections: Why Checking for Underground Tanks is Crucial.

I recently had the pleasure of listening to a talk from John S. Pollard of Pollard Environmental LLC. John, who is a VA Certified Professional Geologist, shed light on a topic that many homeowners might overlook: the importance of understanding underground oil tanks and determining whether or not one exists on a property.

John began by delving into the structure of these tanks, explaining the intricacies of their construction, including fill pipes, vent pipes, and the circulation system. He emphasized, “Many of these tanks, especially those installed before 1980, are prone to leakage.” This was surprising. The corrosion of metal tanks over time can lead to holes, especially at the bottom where moisture and sludge accumulate.

One of the most alarming statistics John shared was that “over 70% of the tanks they’ve inspected in Virginia showed signs of petroleum leakage.” While it’s true that most leaking tanks don’t cause significant problems, there are exceptions. John recounted a case in the Virginia Beach area where “a tank with a hole the size of a dime caused a petroleum discharge into a storm drain,” leading to severe environmental concerns.

The potential environmental impact of such leaks is a pretty big problem. From contaminating groundwater to harming local ecosystems, the repercussions of an unchecked underground oil tank can be serious. As potential homeowners, it’s crucial to be aware of these risks, especially when considering properties with a long history.

John also touched upon the potential for tanks to collapse over time due to metal deterioration. Although this hasn’t been widely observed yet, it’s something homeowners should be aware of. He concluded by discussing a common test used by heating oil companies to detect tank leaks, known as the “water test” or “paste test.” This test, while simple, can be a lifesaver for homeowners, ensuring that their property is safe from potential leaks.

Now, if you’re a homeowner or a potential homeowner, you might be wondering, “What can I do to ensure the safety of an underground tank?” Here are some steps and considerations based on John’s insights:

- Identification: First and foremost, identify if there’s an underground tank on the property. Look for fill pipes, which are usually cut off and flush with the ground, and vent pipes with a mushroom cap on top. These are usually up against the side of the house. A good home inspector should be able to help you with identification.

- Age of the Tank: Understand the age of the tank. If it’s the original tank from before the 1980s, it’s probably at least 40 years old. The older the tank, the higher the risk of leakage.

- Physical Inspection: Check for any visible signs of leakage around the tank area. John mentioned that over 70% of the tanks they’ve tested indicated a petroleum leak, especially around the bottom of the tanks.

- Professional Assessment: If you suspect any issues or just want peace of mind, get a professional to assess the tank’s condition. They can test for any leakage and provide recommendations on next steps.

- Ground Stability: While John mentioned that they haven’t seen tanks collapsing yet, it’s essential to monitor the ground above the tank for any settling or sinking. This could indicate deterioration of the tank below.

- Water Testing: If you have a well or any groundwater source near the tank, get it tested for petroleum contaminants. John shared a case where petroleum from a leaking tank contaminated drinking water wells in a neighborhood.

- Removal or Replacement: If the tank is old, leaking, or poses a risk, consider removing it or replacing it with a newer, safer model. This is a significant step but can prevent potential environmental and health hazards in the future.

In conclusion, understanding the state and potential risks of underground oil tanks is paramount when purchasing a home. As John S. Pollard expertly highlighted, it’s not just about the aesthetics or location of a property; it’s about ensuring the safety and longevity of your investment. So, the next time you’re considering a property, make sure to delve deep, quite literally, and check for those underground tanks. Your future self, and the environment, will thank you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link